Transferwise Review - Cheapest Way to Send Money Online

In this TransferWise Review, we take a look at one of the best, fastest, and cheapest online money transfer company.

Have you ever tried to send money online or do a bank transfer, but found out very quickly that the fees and exchange rate were very high? This can be a big problem, especially if you are paying or transferring a large amount of money.

Have you ever tried to send money online or do a bank transfer, but found out very quickly that the fees and exchange rate were very high? This can be a big problem, especially if you are paying or transferring a large amount of money.

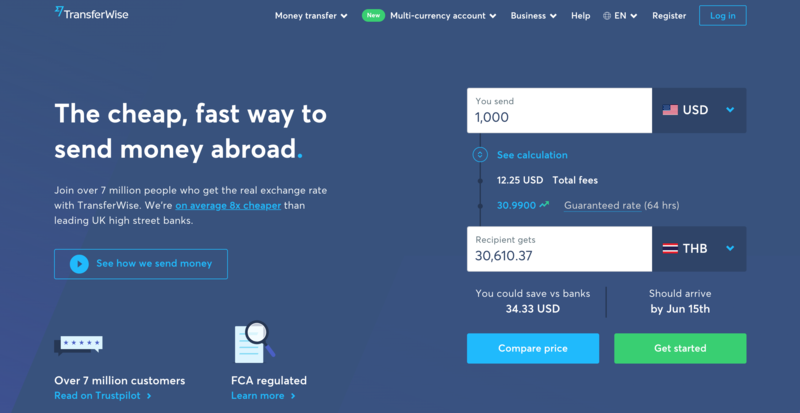

TransferWise is the Solution! Send Money Online with TransferWise and get the real exchange rate. TransferWise on average is 8x cheaper than other banks. This is fantastic!

We can now finally send money online at affordable rates, but people still have questions about TransferWise. Questions like: What is TransferWise? Is TransferWise legit? What is the TransferWise Debit Card and How does TransferWise work? We explain it all in this TransferWise Review.

We can now finally send money online at affordable rates, but people still have questions about TransferWise. Questions like: What is TransferWise? Is TransferWise legit? What is the TransferWise Debit Card and How does TransferWise work? We explain it all in this TransferWise Review.

What is TransferWise?

TransferWise is a British online money transfer service founded in January 2011 by Estonians Kristo Käärmann and Taavet Hinrikus and is based in London. The company supports more than 750 currency routes across the world including GBP, USD, EUR, AUD, and CAD, and provides multi-currency accounts.

Taavet was working in Estonia but lived in England. He was paid in Euro’s but needed to change it to British pounds. This cost him a lot of money every money on hidden bank fees and exchange rates. Using online money transfer services like PayPal was even more expensive than a bank transfer.

Kristo was living in England but had a mortgage in Estonia. He was having the same issues losing a lot of money every month to send money overseas. Together Kristo and Taavet found the solution and with the help of some amazing partners, TransferWise was born. Now everyone can send money online to any international bank account without hidden bank fees, the lowest exchange rate, and an extremely low TransferWise service fee.

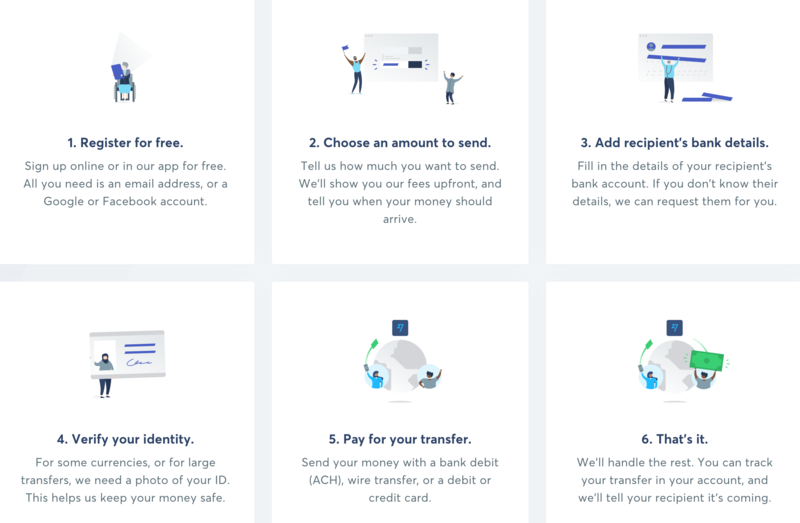

How does TransferWise work

Using TransferWise is easy and fast. To get started you need to first register an account. You can do that for free here on the TransferWise website.

Step 1: Register your free Account

To register online or with the app you need an email address or you can register with your Google or Facebook account.

Step 2: Choose how much money you want to send

TransferWise will tell you before sending money the lowest exchange rate and fee. Then you can decide to cancel, adjust the amount of money or continuo with the transfer.

Step 3: Add the recipient’s bank details.

Fill in the bank account number of the person you want to send money online. What is very handy is that Transferwise can request it for you automatically if you don’t know the recipient’s bank account number.

Step 4: Verify your identity

Only for very large sums or certain currencies, TransferWise needs to verify your identity by law. On my account, I did this only once and then never had to do to again for the same amount that I send. To verify your identity with TransferWise is very easy. You just send a picture of your ID card or Passport to TransferWise and shortly after they will confirm your identity and you are ready to send money.

To register online or with the app you need an email address or you can register with your Google or Facebook account.

Step 2: Choose how much money you want to send

TransferWise will tell you before sending money the lowest exchange rate and fee. Then you can decide to cancel, adjust the amount of money or continuo with the transfer.

Step 3: Add the recipient’s bank details.

Fill in the bank account number of the person you want to send money online. What is very handy is that Transferwise can request it for you automatically if you don’t know the recipient’s bank account number.

Step 4: Verify your identity

Only for very large sums or certain currencies, TransferWise needs to verify your identity by law. On my account, I did this only once and then never had to do to again for the same amount that I send. To verify your identity with TransferWise is very easy. You just send a picture of your ID card or Passport to TransferWise and shortly after they will confirm your identity and you are ready to send money.

Step 5: TransferWise fee

Now you need to pay for your transfer. The TransferWise fee depends on how fast you want the money to arrive on your recipient's account. In the picture below I used the slow option which takes between 2 to 5 days for the cheapest TransferWise fee. Most of the time I use the fast method using my debit card. This makes the fee a bit higher, but nothing compared to like PayPal fees and the money get’s send within 1 day. This is an amazing option if you need the money fast!

Now you need to pay for your transfer. The TransferWise fee depends on how fast you want the money to arrive on your recipient's account. In the picture below I used the slow option which takes between 2 to 5 days for the cheapest TransferWise fee. Most of the time I use the fast method using my debit card. This makes the fee a bit higher, but nothing compared to like PayPal fees and the money get’s send within 1 day. This is an amazing option if you need the money fast!

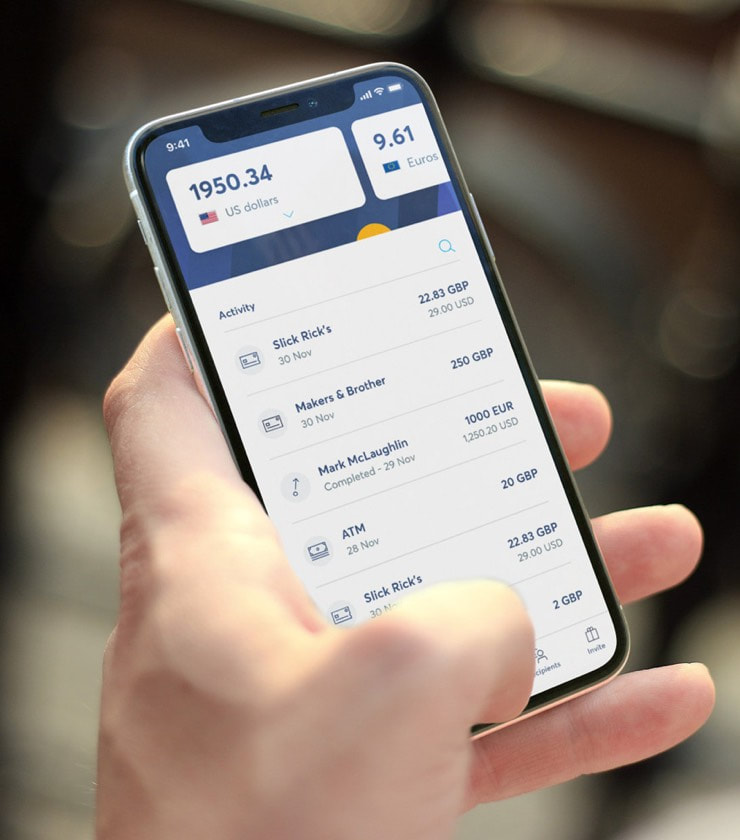

TransferWise Debit Card Review

The TransferWise Debit Card is amazing as you can use it in most countries around the world and you will save a lot of money on transaction fees and exchange rates at foreign ATMs.

I have traveled a lot overseas and every time I want to take money out of an ATM I get charged ridiculous prices. A vacation can quickly go over budget as many people don’t plan these overseas ATM bank charges.

TransferWise found a solution with their Debit Card from Mastercard. Now you get charged the lowest exchange rate and this makes withdrawing money from ATMs affordable again.

TransferWise found a solution with their Debit Card from Mastercard. Now you get charged the lowest exchange rate and this makes withdrawing money from ATMs affordable again.

Where can you use the TransferWise Debit Card?

You can use the TransferWise Debit Card wherever you can use a Mastercard. You can use the TransferWise Debit Card in most countries except for a few:

Sudan and South Sudan, Syria, Venezuela, North Korea, Afghanistan, Chad, Burundi, Central African Republic, Congo and DR of Congo, Cuba, Eritrea, Somalia, Iran, Iraq, Libya, Palestinian Territories, and Yemen.

If you go to these countries you need to use another debit card.

You can also pay online using the TransferWise Debit Card. This is very handy for online shopping and paying for flight tickets etc.

Sudan and South Sudan, Syria, Venezuela, North Korea, Afghanistan, Chad, Burundi, Central African Republic, Congo and DR of Congo, Cuba, Eritrea, Somalia, Iran, Iraq, Libya, Palestinian Territories, and Yemen.

If you go to these countries you need to use another debit card.

You can also pay online using the TransferWise Debit Card. This is very handy for online shopping and paying for flight tickets etc.

How to get the TransferWise card

Follow these steps to get a TransferWise Debit Card:

Step 1: Get a TransferWise account. Click here to Sign up for your TransferWise account. Then add some money into the account. TransferWise will take a few days to verify your account and identity and then you can apply for the debit card.

Step 2: Now click on the Debit card tab of the website or the Account tab in the app, and you'll see an option to order the card.

Step 3: Once you receive your card, activate it by entering the 6-digit code. This code will be sent to you with the card.

Step 4: Now you are ready to use the TransferWise Debit Card in almost any country in the world that has a Mastercard logo with the lowest exchange rates and fees.

Step 1: Get a TransferWise account. Click here to Sign up for your TransferWise account. Then add some money into the account. TransferWise will take a few days to verify your account and identity and then you can apply for the debit card.

Step 2: Now click on the Debit card tab of the website or the Account tab in the app, and you'll see an option to order the card.

Step 3: Once you receive your card, activate it by entering the 6-digit code. This code will be sent to you with the card.

Step 4: Now you are ready to use the TransferWise Debit Card in almost any country in the world that has a Mastercard logo with the lowest exchange rates and fees.

Best Money Transfer App

The best money transfer app that we found is the TransferWise App. The TransferWise App Download can be done here. Keep track of your transfers on the go with the TransferWise mobile app. Make new or repeat transfers - wherever you are - at the touch of a button.

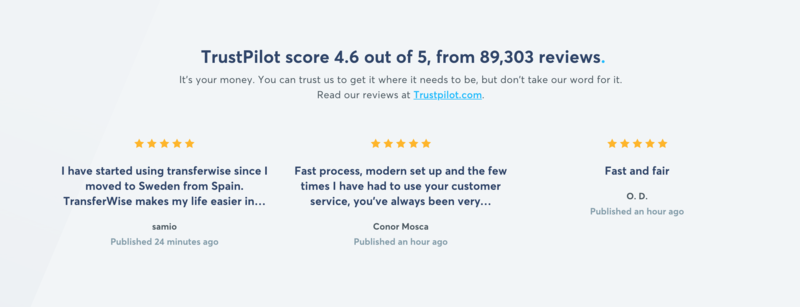

Is TransferWise legit?

TransferWise is an authorized Electronic Money Institution independently regulated by the Financial Conduct Authority (FCA) in the UK.

The TransferWise debit Mastercard is issued by TransferWise Ltd under license by Mastercard International Inc. Mastercard is a registered trademark, and the circle's design on the card is a trademark of Mastercard International Incorporated.

TransferWise is legit and FCA Regulated. It was registered in 2011 and now has over 2000 employees.

The TransferWise debit Mastercard is issued by TransferWise Ltd under license by Mastercard International Inc. Mastercard is a registered trademark, and the circle's design on the card is a trademark of Mastercard International Incorporated.

TransferWise is legit and FCA Regulated. It was registered in 2011 and now has over 2000 employees.

Australia

TransferWise Ltd Australia is regulated by the Australian Securities and Investments Commission (ASIC)

Belgium and the European Economic Area (EEA)

TransferWise Europe SA/NV is regulated by the National Bank of Belgium (NBB).

Canada

TransferWise Canada Inc. is registered with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

Hong Kong

TransferWise Ltd Hong Kong is regulated by the Customs and Excise Department (CCE) of Hong Kong.

India

TransferWise Ltd. is approved by the Reserve Bank of India (RBI) for facilitating outward remittances from India.

Japan

TransferWise Japan K.K. is regulated by the Kanto Local Financial Bureau.

Malaysia

TransferWise Malaysia Sdn. Bhd. is regulated by Bank Negara Malaysia (Central Bank of Malaysia).

New Zealand

TransferWise operates as a foreign entity and is supervised by the Department of Internal Affairs (DIA).

Singapore

TransferWise Singapore Pte Ltd is a company incorporated under the laws of Singapore.

The United Kingdom and the European Economic Area (EEA)

TransferWise Ltd is authorized as an Electronic Money Institution (EMI) by the UK Financial Conduct Authority with registration number 900507, with rights across the EEA.

United States

TransferWise Inc. is registered with the Financial Crimes Enforcement Network (FinCEN).

United Arab Emirates (UAE)

TransferWise Nuqud Ltd is regulated by the Abu Dhabi Global Market (ADGM) Financial Services Regulatory Authority (FSRA).

You can see more information about security and communication by downloading the TransferWise Privacy Policy here.

TransferWise Ltd Australia is regulated by the Australian Securities and Investments Commission (ASIC)

Belgium and the European Economic Area (EEA)

TransferWise Europe SA/NV is regulated by the National Bank of Belgium (NBB).

Canada

TransferWise Canada Inc. is registered with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

Hong Kong

TransferWise Ltd Hong Kong is regulated by the Customs and Excise Department (CCE) of Hong Kong.

India

TransferWise Ltd. is approved by the Reserve Bank of India (RBI) for facilitating outward remittances from India.

Japan

TransferWise Japan K.K. is regulated by the Kanto Local Financial Bureau.

Malaysia

TransferWise Malaysia Sdn. Bhd. is regulated by Bank Negara Malaysia (Central Bank of Malaysia).

New Zealand

TransferWise operates as a foreign entity and is supervised by the Department of Internal Affairs (DIA).

Singapore

TransferWise Singapore Pte Ltd is a company incorporated under the laws of Singapore.

The United Kingdom and the European Economic Area (EEA)

TransferWise Ltd is authorized as an Electronic Money Institution (EMI) by the UK Financial Conduct Authority with registration number 900507, with rights across the EEA.

United States

TransferWise Inc. is registered with the Financial Crimes Enforcement Network (FinCEN).

United Arab Emirates (UAE)

TransferWise Nuqud Ltd is regulated by the Abu Dhabi Global Market (ADGM) Financial Services Regulatory Authority (FSRA).

You can see more information about security and communication by downloading the TransferWise Privacy Policy here.

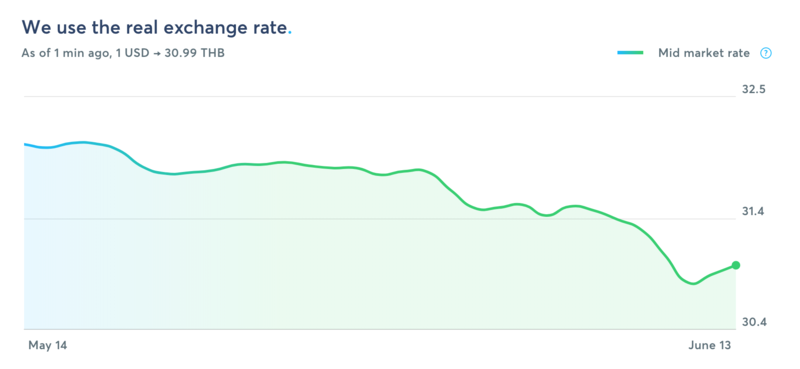

TransferWise Exchange Rate

The TransferWise Exchange Rate is the real exchange rate with no hidden fees. An average money transfer with TransferWise is 80% more efficient than banks. These saving are passed on to you. The best exchange rate to send money online is trough TransferWise.

Hidden Bank Fees

Picture this, you owe money to your brother in Brussels, you're exchanging pounds for your trip to Peru or your freelancer in France wants to be paid in their local currency and you need to know how much money to convert.

You think it would be simple to just Google the exchange rates and send it through a bank. Only to find out that after you convert the money you realize the amount is way less than you expect and everyone is annoyed how did this happen.

You think it would be simple to just Google the exchange rates and send it through a bank. Only to find out that after you convert the money you realize the amount is way less than you expect and everyone is annoyed how did this happen.

Foreign exchange providers are ripping you off because they're not required by law to be transparent. They hide extra fees in the exchange rate and add-on costs as your money moves across borders.

It is estimated that people are losing 12.5 billion euros of their hard-earned money by using banks or PayPal to send money online and that's in Europe alone! TransferWise thinks that it is unfair.

Banks should have to tell you the true cost of a transfer just like a supermarket has to tell you the price of milk. Our governments are starting to take notice but until they catch up we need to be aware. TransferWise fights the hidden bank fees.

It is estimated that people are losing 12.5 billion euros of their hard-earned money by using banks or PayPal to send money online and that's in Europe alone! TransferWise thinks that it is unfair.

Banks should have to tell you the true cost of a transfer just like a supermarket has to tell you the price of milk. Our governments are starting to take notice but until they catch up we need to be aware. TransferWise fights the hidden bank fees.

Conclusion TransferWise Review

I hoped that this TransferWise Review helped in learning more about TransferWise. I travel a lot and TransferWise has saved me thousands of dollars in hidden fees, foreign ATM rates, Exchange Rates, and other money transfer costs.

TransferWise also helped during COVID-19 time where we send money online to our family members regularly and with TransferWise this was affordable and that was very important especially in COVID-19 time.

I highly recommend you give TransferWise a try. You can sign up for free here. Please share this TransferWise Review and help others to find the faster way to send money with the lowest cost and exchange rates.

TransferWise also helped during COVID-19 time where we send money online to our family members regularly and with TransferWise this was affordable and that was very important especially in COVID-19 time.

I highly recommend you give TransferWise a try. You can sign up for free here. Please share this TransferWise Review and help others to find the faster way to send money with the lowest cost and exchange rates.

Next Article: Is TubeBuddy Safe?